Internal Control System

Home»Corporate Governance» Internal Control System

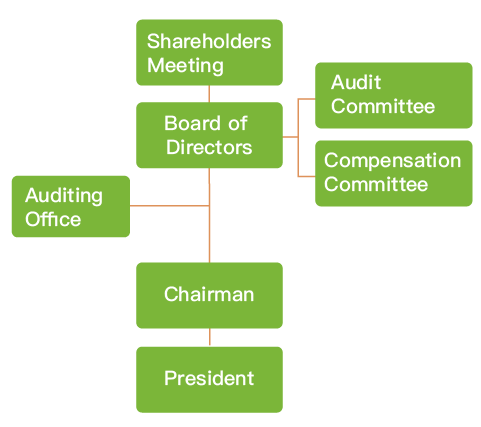

The Auditing Office

- The Company has established the auditing office under the Board of Directors as shown in the organization chart above in accordance with Article 11 of the “Rules Governing the Establishment of Internal Control System by the Public Companies” governed by the FSC. The auditing office is composed of four members, including one chief auditor, one officer and two auditing members. All members are full-time employees designated in auditing works and operate independently. Key functions of the auditing office is to conduct periodic and irregular auditing works on financial reports and business operations in order to fully understand the compliance of internal control system, as well as the comprehensiveness, reasonableness and effectiveness of the internal control system. Analysis, assessment and suggestion reports are generated to achieve the target of using reasonable costs to effectively control and improve quality, to increase efficiency and to reduce operational risks. Hence, assisting the Board of Directors and management team to examine and review flaws of internal control system, balance the effectiveness and efficiency of business operations. Timely provide suggestions for improvement in order to ensure the continuous and effective implementation of internal control system and provide reference for review and adjustments on internal control system.

The Appointment and Dismissal of Chief Auditor

- The appointment and dismissal of Chief auditor and auditors are conducted in accordance with the Company's recruitment (appointment) regulations and relevant laws and regulations, and all internal auditors are qualified to practice. Their appointment, dismissal, evaluation, salary and compensation assessment are performed once a year and are signed by the Chief auditor and submitted to the Chairman for approval.

- The appointment or dismissal of the internal Chief auditor must be approved by the Audit Committee and submitted to the Board of Directors for resolution. The Chief auditor is required to take continuing education courses and their status of continuing education is also reported back to the competent authorities by law.

Key Functions of Chief Auditor:

- Promotion, amendment, submission and execution of the Company’s internal control system

- Establishment, amendment, submission and execution of internal audit work on the Company and its subsidiaries

- Planning and submission of the Company’s auditing plan on its subsidiaries

- Supervision, auditing review report and submission of the Company’s auditing plan on its subsidiaries

- Supervision of the reporting and on-line filing of internal control matters and internal audit regulations

- Periodically report auditing plan to members of the Audit Committee and independent directors. The chief auditor also attends board meetings as a guest to report the status of internal audit

- Supervision, assessment, management and training of subordinates

Key Functions of Auditing Members:

- Collection, investigation, organization, analysis and research of data in accordance with auditing plan. Propose system regulations, provide suggestions on operation improvement or list operation defects and generate auditing reports.

- Execution of ad hoc internal control auditing works as instructed by the Board of Directors, Chairman, members of the Audit Committee, independent directors, as well as other auditing businesses assigned. Preparation of auditing report.

- Promotion, assistance and consolidation of internal control self-assessment within the Company.

- Perform auditing work on subsidiaries.

Execution of Annual Auditing Plan and Reporting

- Execution of Auditing Plan

- The auditing office formulates annual auditing plan in accordance with Article 8, 13 and 22 of the “Rules Governing the Establishment of Internal Control System by the Public Companies” as well as other regulations in relations to risk control management. The auditing office would execute the following auditing works in order to assess the completeness and reasonableness of the Company’s nine auditing principles as well as the design of the Company’s internal control system on other management operations. Effectiveness of execution among each department is also assessed.

- In compliance with regulations governed by the Securities and Futures Bureau of the FSC, the auditing office would perform at least the following auditing work on parent company and subsidiaries annually:

- Monthly audit on derivatives transactions, quarterly audit on providing endorsements and guarantees, financial guarantees, or lending funds to others

- Submit follow up report on areas of improvement within three months from the previous auditing work

- Perform self-examination on the execution of internal control system annually in order to accelerate the Company’s operation efficiency

- Arrange appropriate time to perform the nine internal auditing principles and other operations during mid-year

- Audit report and follow up report are submitted to the Audit Committee and independent directors before the end of following month in accordance with “Regulations Governing Establishment of Internal Control Systems by Public Companies”

Reporting

- The auditing office has completed the following on-line reporting items within the time frame specified by the Securities and Future Bureau:

- Report “auditing plan for the following year” by the end of December

- Report “personnel data on the chief auditor and auditing members” by the end of January

- Report “execution status of the auditing plan” of the previous year by the end of February

- Report “statement of internal control” of the previous year by the end of March

- Report “area of improvement and irregularities identified on the internal control system” of the previous year by the end of May